extended child tax credit 2021

The Child Tax Credit was expanded for tax year 2021 so parents can get half of the credit early before filing their taxes in early 2022 through advanced monthly payments. Originally it offered taxpayers a tax credit of up to.

The Child Tax Credit Toolkit The White House

Why have monthly Child Tax Credit payments stopped.

. Join The Millions Who File Smarter And Get Your Taxes Done Right Guaranteed. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. Simple or complex always free.

Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. Child Tax Credit. A recent study published by the Urban Institute shows that if the child tax credit is extended beyond 2021 it could substantially reduce child poverty in the vast majority of US.

Filers will receive a max credit of 3600 for each child age 5 or younger according to the IRS. Here is some important information to understand about this years Child Tax Credit. Households with children who qualified for the 1400 stimulus check that went out in March 2021 were eligible for the child tax credit.

In 2021 The America Rescue Plan Act ARPA expanded the CTC once again. As part of the American Rescue Act signed into law by President Joe Biden in March of 2021 the child tax credits were expanded to up to 3600 per child from the previous. For children between the ages of 6 and 17 the max credit will be 3000.

Starting in mid-July families will receive up to 300 per child each month through December as part of the Child Tax Credit bringing economic security to an estimated 25. The final payments were issued to. WASHINGTON DC Today House Ways and Means Committee Chairman Richard E.

In 2020 the two child poverty measures began to diverge due to the impact of large anti-poverty programs established or expanded in response to the COVID-19 pandemic. House-passed version would have extended the 2021 expansion of the child credit for one year 2022 while also making the credit fully refundable permanently beginning in. The maximum per-qualifying child was expanded by an additional amount of 1600 for children.

Ad Get Your Maximum Refund Guaranteed Even If Youve Received The Advance Child Tax Credit. Rhode Island issued one-time tax rebates of 250 per child up to 3. Oklahoma gives families 100 per child under the age of 17.

The Child Tax Credit provides money to support American families. What Is the Expanded Child Tax Credit. The child tax credit was temporarily expanded for 2021 under the American Rescue Plan Act passed by Congress in March 2021.

The Child Tax Credit Update Portal is no. The ARPAs expansion of the child tax credit resulted in a one-year fully refundable credit of up to 3000 per child age 6 and up and 3600 for children under age 6 to. Neal D-MA released the following statement on the success of the Child Tax Credit after a.

Illinois Residents Urged to File Taxes to Qualify for Up to 3600 in Credits Published May 13 2021 Updated on May 13 2021 at 427 pm NBCUniversal Media. June 14 2021. This is a permanent credit.

The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for qualifying children 6. File a federal return to claim your child tax credit. Census report finds that child poverty declined 46 percent in 2021 Counties can continue efforts to boost enrollment in the child tax credit before it expires in October.

The child and dependent tax credit was introduced in 1997 as part of the Taxpayer Relief Act. The maximum credit amount has increased to 3000 per qualifying child between. The American Rescue Plan Act expands the child tax credit for tax year 2021.

Included in President Joe Bidens American Rescue Plan the 19tn coronavirus relief package is an extended child tax credit for qualifying families. The legislation made the existing 2000.

The Child Tax Credit Toolkit The White House

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

/cdn.vox-cdn.com/uploads/chorus_image/image/71300653/bigbill.0.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

Child Tax Credit Definition Taxedu Tax Foundation

The Child Tax Credit Toolkit The White House

The Child Tax Credit Toolkit The White House

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Tax Tip Caution Married Filing Joint Taxpayers Need To Combine Advance Child Tax Credit Payment Totals From Irs Letters When Filing Tas

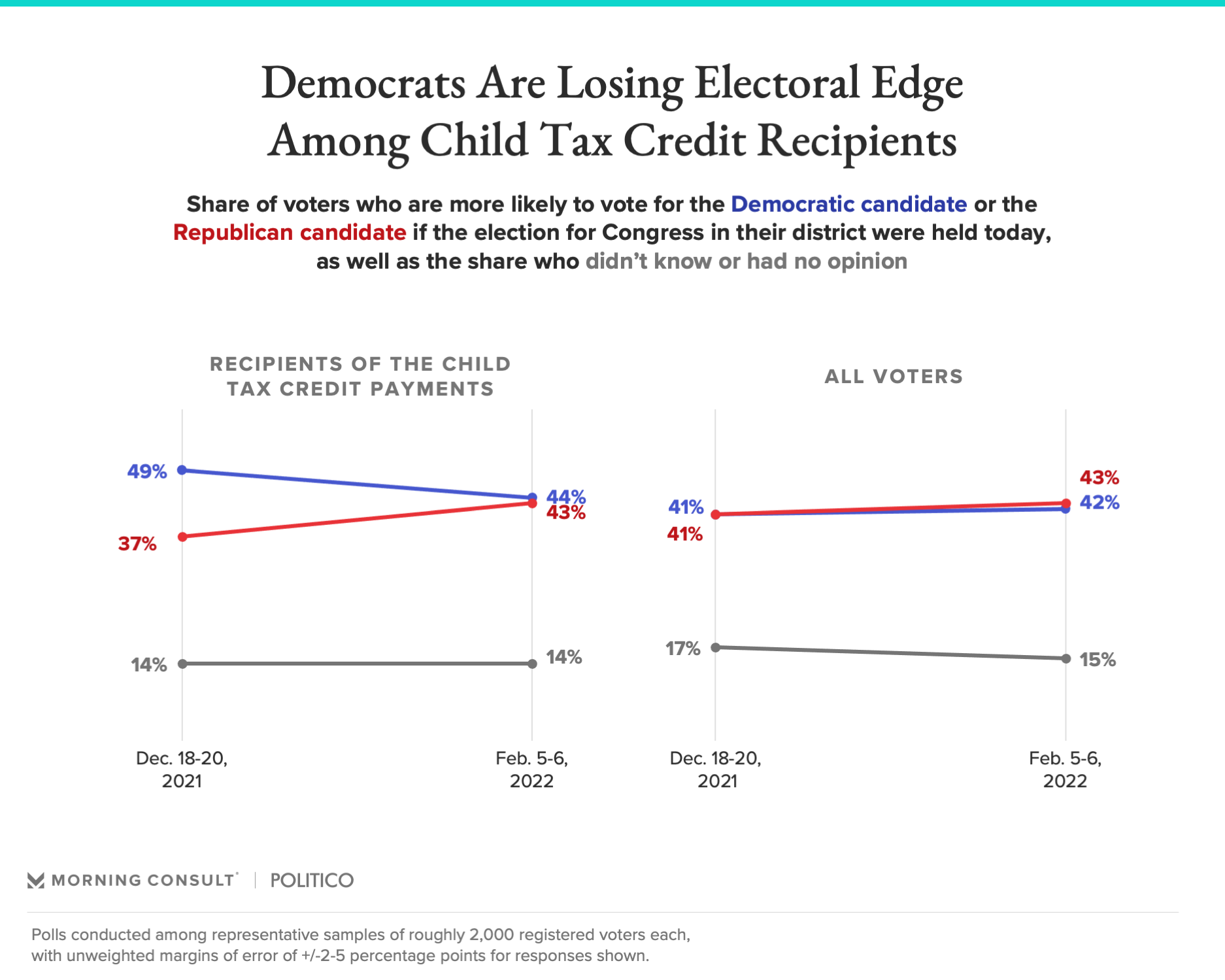

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

2021 Child Tax Credit Advanced Payment Option Tas

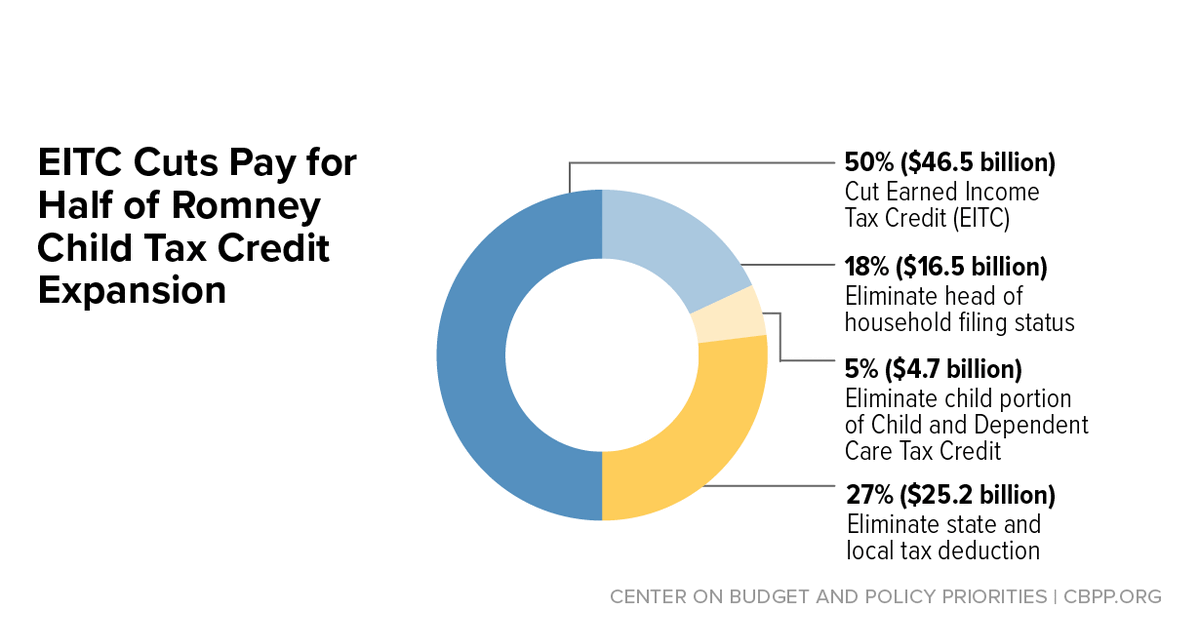

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Free Tax Information In 2022 Estimated Tax Payments Tax Software Filing Taxes

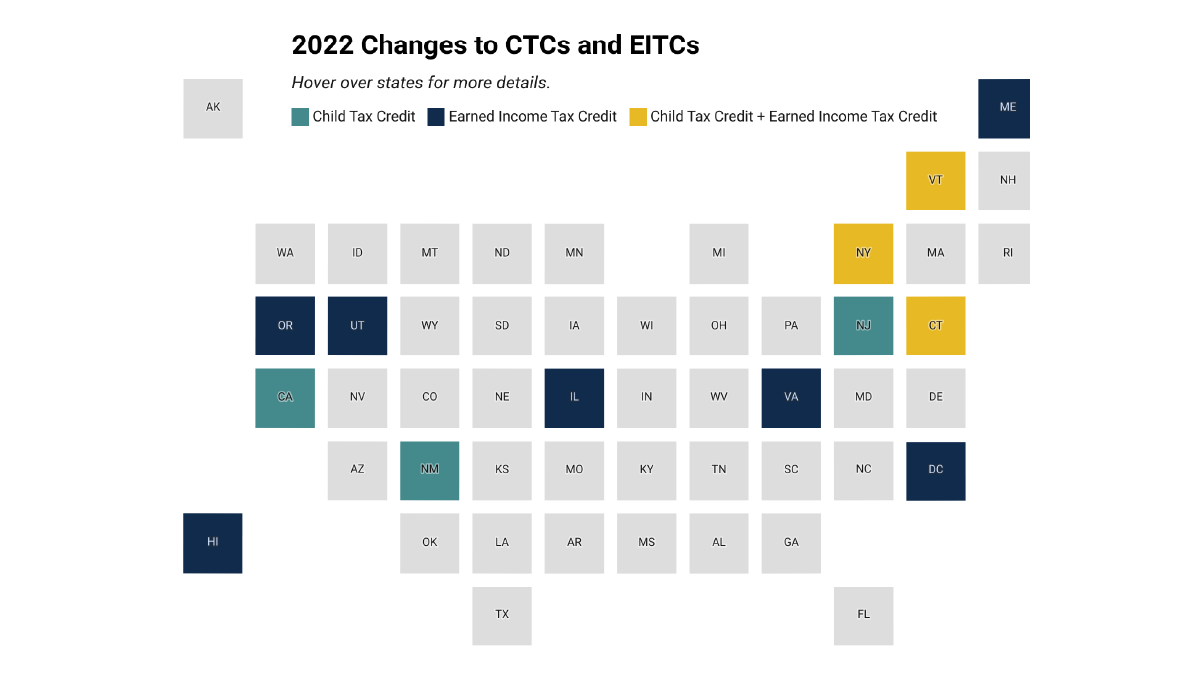

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

Gauging The Impact Of The Expanded Child Tax Credit S Expiration